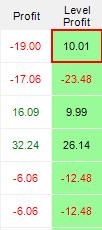

In the example below the following bets have been placed before the level profit column has been used then the level profit column is clicked against Selection 1 then Selection 2.

LAY Selection 1 @ 4.40 £2.94

LAY Selection 2 @ 11.00 £1

BACK Selection 3 @ 4.60 £5

BACK Selection 4 @ 8.00 £5

This is the position before backing Selection 1 using the level profit column. The level profit column is showing the future P&L based on £6.42 being backed. The LowProfit figure is before commission which is why it is higher than £16.09. The result is basically equalising the profit between the current selection (Selection 1) and the selection with the lowest positive profit (Selection 3)

Profit = -£19.00, LowProfit=£16.94, Back odds=5.6

Stake = Abs(Profit)+LowProfit / odds = £6.42

Note: Abs(profit) means ignore the sign so -19.00 becomes 19.00

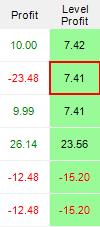

This is the position before backing Selection 2 using the level profit column. The level profit column is showing the future P&L based on £2.72 being backed which is equal to your final position. You can see the same is happening here, the profit between the current selection (Selection 2) and the selection with the lowest profit (selection 3) is being equalised.

Profit = -£23.48, LowProfit=£10.52, Back odds=12.5

Stake = Abs(Profit)+LowProfit / odds = £2.72

Typically with our competitor’s products the green up formula will only take into account bets on the current selection so your final P&L would look like the following after hedging Selection 1 and Selection 2. The result is that you have locked in a small profit on each reducing your liability of the two £5 back bets.

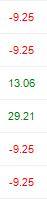

In all cases to achieve a fully greened up position you would need to use the level profit column to place further hedge bets on Selection 3 and Selection 4. Betting Assistant does not have the facility to hedge all selections in one click, we will however be adding this to a future release.

This formula works well in a two outcome event, eg. If you backed tennis player A and a profit could by locked in by laying player A. In this instance a profit could also be achieved by backing player B, the formula will allow you to green up by backing player B and this profit might be more than if laying player A, you have the choice.